Consolidation of the Company’s operating model:

Focused on 6 Strategic Regions

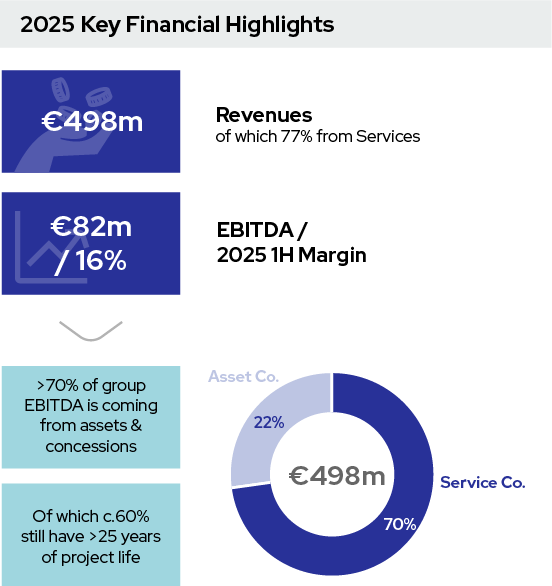

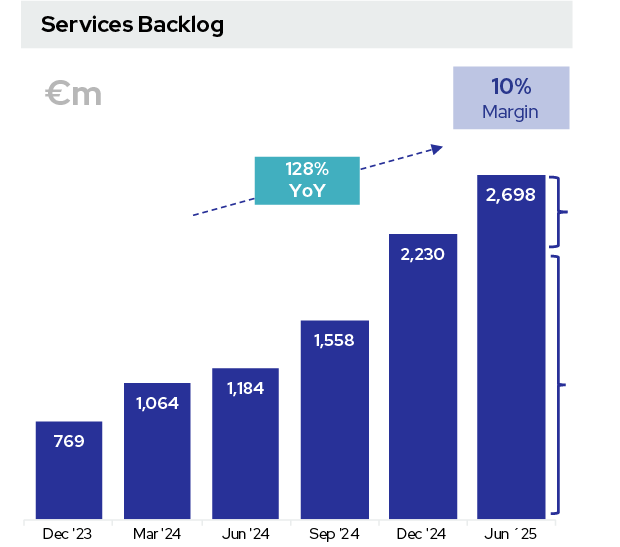

Sustained growth in Revenues, EBITDA and Operating Cash Flow generation

Asset Co.: €145 m

Service Co.: €80 m

€225 m EBITDA 2025

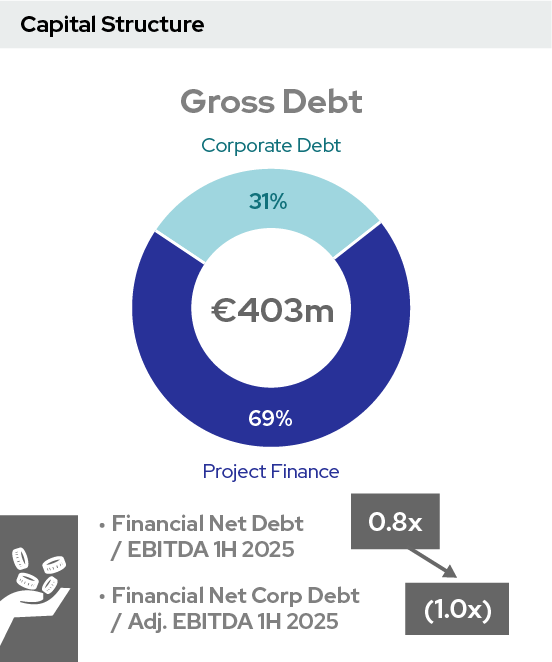

Net Financial Debt €204m

Net Financial Debt / EBITDA 0,9x

Note: Abengoa S.A.’s productive units have only been consolidated within the Company’s results since the date on which the acquisition took effect pursuant to the terms of the Share Purchase Agreement (April 18, 2023). Therefore, the Group’s consolidated statement of income and the Group’s consolidated statement of cash flows for the year ended December 31, 2023 include (i) twelve months of operations of the Company and (ii) approximately nine month of operations of the Abengoa productive units. 1) EBITDA is an APM calculated as the sum of Operating profit and Amortization and charges due to impairments, provisions and amortizations. EBITDA excluding corporate costs (-€11m). 2) Adjusted operating cash flow is an APM calculated as EBITDA less changes in working capital, capital expenditures and taxes. 3) Debt with recourse sitting at corporate level, composed of debt with credit institutions and lease liabilities. 4) Debt without recourse sitting on the 2 water concessions and SPP1 energy Project. 5) Net Debt/EBITDA is an APM calculated as Net Debt defined as the sum of the Group’s Debt with credit institutions and others and Project finance debt minus Cash and cash equivalents) divided by EBITDA. 6) Adj. Net Debt/ Adj. EBITDA is an APM calculated as Adjusted Net Debt (comprised of debts with credit institutions, plus lease liabilities and other financial liabilities, less cash and cash equivalents) divided by Adjusted EBITDA (comprised of EBITDA excluding concessions). 7) €103m reported EBITDA includes corporate and other costs (-€11m). EBITDA split by business unit is calculated over EBITDA excluding corporate costs (€114m). 8) Calculated as EBITDA contribution of Agadir’s two water concessions and Brazil bioenergy project, all divided by Group EBITDA excluding corporate costs. 9) Normalized Cash Flow Conversion is an APM calculated as Adjusted Operating Cash Flow minus one-off working capital expenses pertaining to the Centro Morelos, Dewa, Agadir, Salalah, Rabigh and Taweelah projects. These one-off working capital expenses pertain to expenses incurred prior to the acquisition of Abengoa S.A.’s productive units.

Luis Arizaga Zárate

Independent Director

Member of the Audit Committee

Date of appointment: September 17, 2024

Shareholding in Cox Abg Group, S.A.: 11,514 shares

Partner of Exus Management Partners (Exus) and GenuX Power, a global renewable energy platform with offices in nine countries, managing 11GW of installed capacity, including 2.6GW in Mexico between wind and solar energy projects. Holds a Master of Business Administration (MBA) from the Leonard N. Stern School of Business at NYU in New York, and a bachelors degree in Accounting and Finance from ITESM in Mexico.

Prior to joining EXUS in 2019, he founded EIRA Capital, an investment platform focused on Energy and Infrastructure transactions in Mexico, and Latin America. He was also part of Australia’s Macquarie Group in Latin America, where he spent more than 7 years in the Macquarie Capital and Macquarie Funds divisions, working on fund capital raising, equity investments, asset management activities, as well as third party advisory roles on energy and infrastructure transactions in Mexico and Latin America. During his years at Macquarie, he also held board positions in the several investments made by Macquarie which covered energy, public private partnerships, roads, and telecom companies. In addition, his previous involvement at financial institutions include positions in the investment banking teams of Deutsche Bank’s M&A group in New York, and Citibank’s M&A group in Mexico.

Other former relevant positions include his role as independent member of the investment committee of the Instituto del Fondo Nacional de la Vivienda para los Trabajadores (Mexican mortgages and housing government agency).

Enrique Riquelme Vives

Presidente Ejecutivo

Fecha de nombramiento: 17 de septiembre de 2024

Participación en el capital social de Cox Abg Group, S.A.: 50.612.744 acciones

Presidente Ejecutivo de Cox, tras iniciar su andadura profesional en el sector inmobiliario y de la construcción, en 2010 fundó Grupo El Sol en Panamá, especializado en operaciones de minería, cemento, infraestructuras y energía. Con el tiempo, la empresa se convertiría en el mayor proveedor de arena de la UTE responsable de la ampliación del canal de Panamá. Posteriormente, pasó a liderar las fases de oferta y desarrollo de Rainbow 50: el proyecto fotovoltaico de mayor envergadura ejecutado en América Latina hasta aquel momento.

Ha recibido varios galardones por su contribución al mundo empresarial en España, entre ellos el Premio del Certamen Nacional de Jóvenes Emprendedores 2018. También ha sido distinguido como uno de los «100 latinos más influyentes comprometidos con la acción climática» y uno de los «100 españoles más creativos del mundo de los negocios» según la revista Forbes. Actualmente, es miembro del Consejo Internacional de la San Telmo Business School y preside el Consejo Asesor de la Fundación Scholas para Panamá, Centroamérica y Caribe.